Trade intelligence by futuri

From Headlines to Alpha

See the News Behind Every Tick. Trade the Story Before the Street.

TopicPulse turns breaking headlines into tradeable signals that are tagged, scored, and delivered before it hits Bloomberg terminals.

How it works

Why Quants Choose TopicPulse

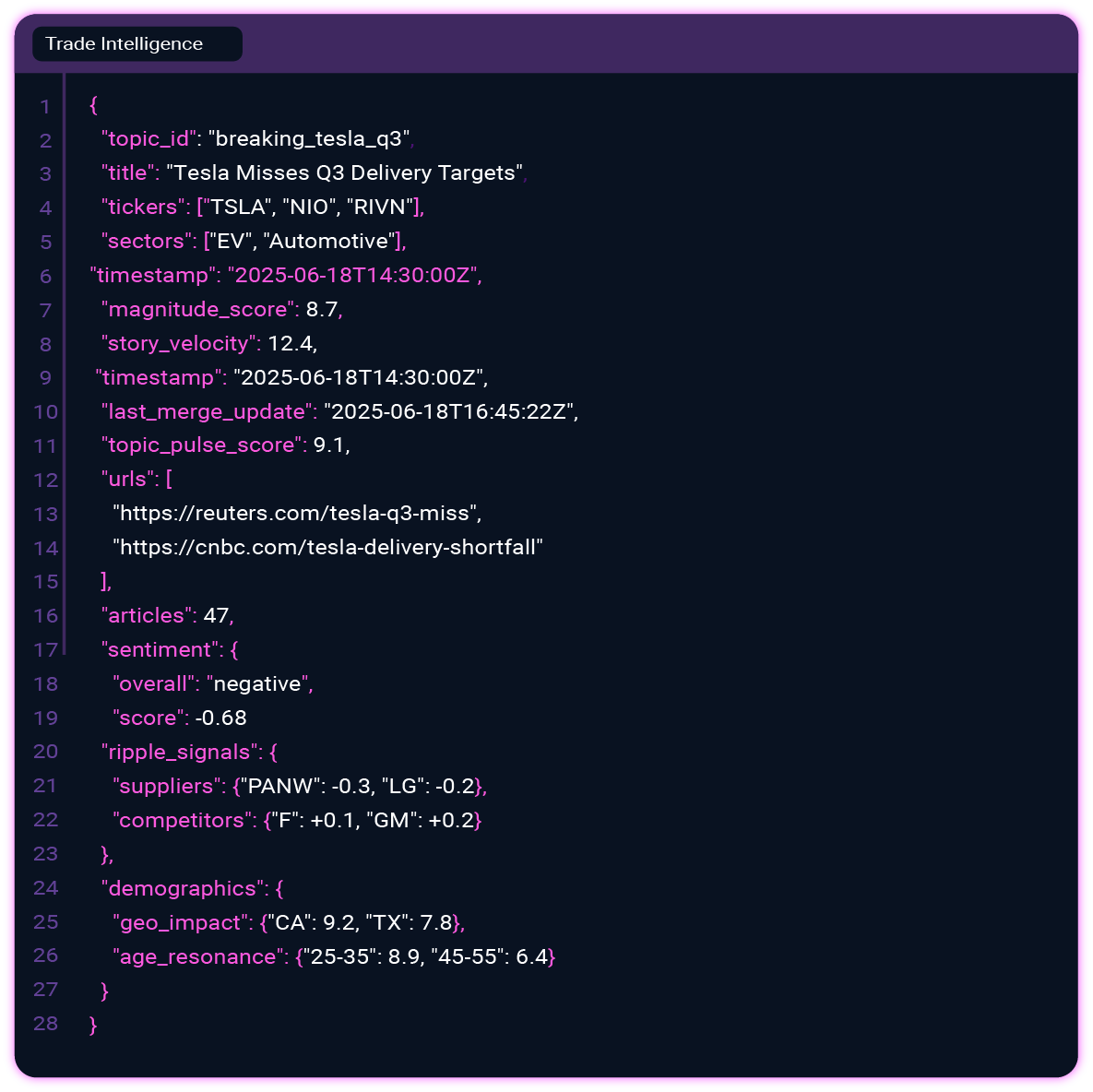

Magnitude Scoring

Our proprietary algorithm quantifies story-driven price moves before they hit analyst desks. Not just sentiment, but actual impact prediction.

Ripple Engine Intelligence

When Tesla announces battery breakthroughs, what happens to lithium miners? Our AI maps secondary effects across your entire portfolio in real-time.

LLM-Powered Ticker Tagging

Instant, accurate mapping of every story to relevant tickers and sectors. Zero manual processing, maximum coverage.

Built for Your Workflow

Access data via REST API, batch export (CSV, JSON, Parquet), or zero‑copy Snowflake tables.

No ETL hassle, maximum flexibility.

The TopicPulse Advantage

Feature

TopicPulse

Polygon.io

Alpha Vantage

Signal Intelligence

✓ Magnitude Scoring™ + Impact Prediction

✗ Raw market data only

✗ Fundamentals

AI Story Tagging

✓ LLM-powered ticker/sector mapping

✗ Symbol lookup only

✗ Manual categorization

Demographic Layers

✓ Age, geo, sentiment breakdowns

✗ Not available

✗ Not available

Ripple Analysis

✓ Secondary impact tracking

✗ Single-ticker focus

✗ Single-ticker focus

Data Warehouse Ready

✓ API access, Snowflake, Databricks, S3, and CSV

⚠️ API-only

⚠️ CSV exports

Data Products That Actually Move P&L

Real-Time News Intelligence Feed

AI-tagged stories with instant ticker mapping and impact scoring.

What You Get:

250K+ sources monitored 24/7, scored and indexed by social engagement

Sub-second tagging of tickers, sectors, and impact scores

Demographic breakdowns by region, age, engagement velocity

Confidence scoring for model risk management

Delivery Options:

REST API for real-time ingestion

Zero-copy Snowflake tables (Marketplace ready)

S3 exports: CSV, Parquet, JSONL

Built-in UI with ticker search

Ripple Signal Engine

Quantify cascade effects when major stories break.

Co-movement detection across related entities

Sector contagion mapping for risk management

Partner/competitor impact scoring for pairs trading

Thematic correlation signals for portfolio optimization.